Can we turn 786 ETH into 100,000 ETH by the year 2022? There is only one way to find out.

Article Breakdown

- TLDR: A quick breakdown of this experiment.

- Nominations: Alist of nominated individuals and communities.

- Valuations: A breakdown of how much everyone is eligible to receive and the current valuation, go here.

- Involvement: How to get involved and help us reach our 100k ETH goal, go here.

- Claims: If you have been nominated and are looking to claim your tokens, DM Zachary Dash on Twitter for verification.

- Growth Hacking: Our views on growth marketing and how we’ve used this to structure the experiment, go here.

- Updates: Follow along on this 100k ETH growth experiment, join our Discord here and/or text ‘100k’ to +18444864400 for updates.

To set the experiment in motion, a proposal will be made to Blockzero Citizens. Voting will take place from June 17th to June 24th on our governance page.

TLDR;

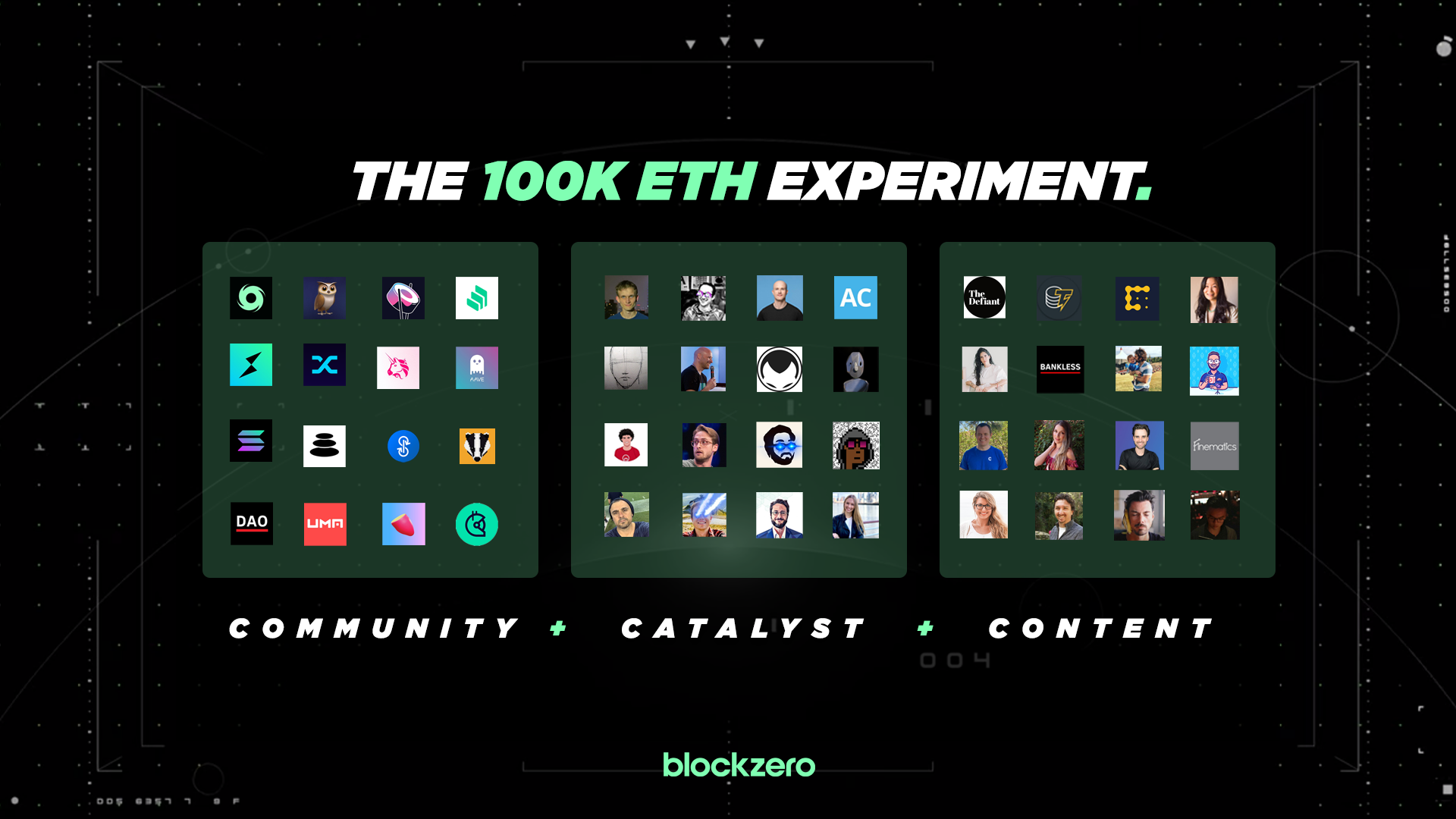

Blockzero Labs has nominated a total of 125 communities, builders, and content creators across the decentralized world. These individuals and groups are eligible to claim 1 XIO Option token.

There are only 100 XIO Option tokens in existence. These tokens will be redeemed on a first-come-first-serve basis.

The XIO Option tokens are convertible up to 10M XIO tokens based on our primary KPI. Our primary KPI is the Total Liquid Value (TLV) inside the Blockzero Vortex — a decentralized venture fund.

These Options will be 100% convertible once the Vortex reaches a Total Liquid Value (TLV) of 100,000 ETH. At this time, one Option is worth 0.069168 ETH ($172.92).

If the market cap of XIO becomes equal to the TLV of the Vortex at the time we hit our primary KPI, one Option would currently be worth 250 ETH ($625,000).

What is Blockzero?

Here is how to understand the Blockzero project in one tweet.

The Blockzero project has been surfing along the waves of Web 3.0 for a year and a half now with one vision in mind:

Build, launch, and scale ideas into the decentralized world.

While never raising capital, Blockzero has been 100% bootstrapped through the pure passion and curiosity of our community of Citizens.

Experiment. Learn. Adapt. Repeat.

At the core of Blockzero is a desire for experimentation.

Sometimes these experiments flat out fail like the time we thought it was a good idea to pay 12% for individuals who join our “SMS Insider”.

Sometimes in these experiments, we stumble across really cool ideas like Flashstaking and decide to turn it into an instant upfront yield protocol.

Sometimes in these experiments, we start building tools for ourselves and end up open-sourcing them to the world like Dropzero — a universal token distribution Dapp that allows you to send to 1M+ wallets with one Ethereum gas transaction.

Sometimes, when luck meets opportunity, these experiments allow us to get ahead of industry trends like the XLP program we started in 2019 before “liquidity mining” was a thing.

Through the ups and the downs, we have documented our journey out in the open. This unapologetically transparent style has offered insight and empowerment to those who want to want to jump in and help us navigate the muddy waters at such an early stage.

No matter the thesis, the one constant in all our experiments is the consistent desire to learn, adapt and relentlessly pursue our curiosities.

Today, we are following our biggest curiosity yet by launching the 100k ETH Experiment.

What is the 100k ETH Experiment?

ex•per•i•ment

A test, trial, or tentative procedure; an operation for the purpose of discovering something unknown

Our unknown in this experiment is simple — can we increase the Blockzero Vortex to 100k ETH in TLV through a mass-scale KPI option event?

The plan of attack:

- Identify a group of individuals & communities we believe add extreme value to the decentralized world

- Incentivize them with the proper long-term ownership, opportunity, and upside in Blockzero

- Involve them in our project and invite them to add value

1) Identify

To identify who we believed could help us push the project forward, we nominated individuals and projects based on the three divisions of Blockzero:

- Thinkers: DAOs + communities using governance, discussion, and ideas to impact change

- Creators: The developers and founders helping shape the decentralized world we all live in

- Growers: The content creators and publications who help onboard people into the world of crypto

Thinker Nominations | DAOs + Communities

One thing all great projects have is a great community behind them. Without the thoughts and energy behind these communities, most projects would fail.

Below is a list of DAOs and communities that have inspired us with their massively organized community engagement and involvement.

MakerDAO, Aragon, MetaCartel Ventures, MolochDAO, Colony, Bankless DAO, Gitcoin, Syndicate DAO, 1Hive, YAM Finance, FWB DAO, BadgerDAO, Aave, Compound, Polygon, Yearn Finance, Curve, Uniswap, Sushi, Synthetix, Balancer, Index Coop, Indexed Finance, UMA Protocol, Liquity, Harvest, r/ETHDev, Solana, Avalanche, PolkaDot, Cosmos, THORchain, Alpha Finance Lab, InstaDapp, Tornado.cash, Alchemix, BarnBridge, Reflexer Labs, mStable, 1inch

These communities can hold onto their Option token or distribute it to their community members as desired.

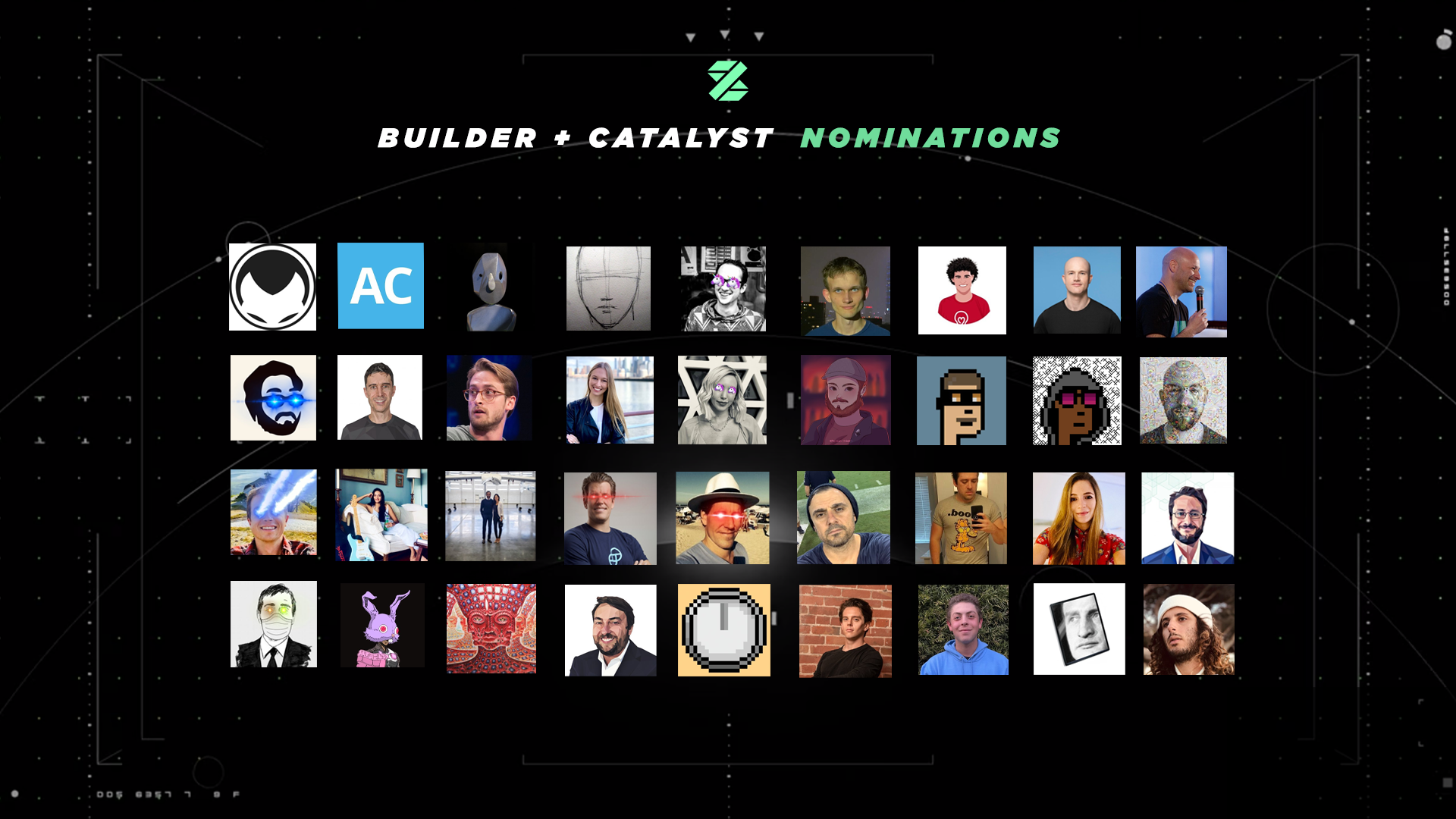

Creator Nominations | Builders + Catalyst

The reason the world of Web 3.0 exists as we now know it is because there are individuals who pushed this reality into existence.

The following individuals were nominated for their continuous efforts to shape the industry through their thoughts, capital, or execution.

Kain.eth, Taylor Monahan, Fernando Martinelli, Joseph Lubin, Chris Burniske, Tyler Winklevoss, Cameron Winklevoss, Chamath Palihapitiya, Rune Christensen, Stani.eth, Garry Tan, Sacha, Jack Du Rose, Tim Beiko, SBF, Billy Luedtke, Balajis, Spencer Noon, Vance Spencer, Hayden Adams, Andreas Antonopoulos, Julien Bouteloup, Erik Voorhees, Brian Armstrong, Vitalik Buterin, Adam Cochran, Rob Paone, Ashleigh Schap, Emin Gün Sirer, Zhu Su, Anthony Sassano, Eric.eth, antiprosynthesis.eth, Naval, samczsun, Nick Sawinyh, DCinvestor, Andre Cronje, Spencer Bogart, Tom Schmidt, Mike Demarais, Mike Novogratz, Joseph Delong, Tyler Reynolds, Matt Huang, Ryan Berckmans, Robert Leshner, Gary Vaynerchuk, Jesse Walden, Nodar, Hudson Jameson, Linda Xie, Ari Paul, Arthur, Alex Svanevik, Jack Lipstone, Brian Flynn, banteg, Priyanka Desai, Amanda.eth, Anatoly Yakovenko, Gavin Wood, Ethan Buchman, Paul Razvan Berg, Austin Griffith, Ryan S Adams, David Hoffman

Grower Nominations | Content Creators + Publications

While the industry will always need builders, the magicians who relay our visions into the minds of the mainstream audiences are the content creators and media outlets of the world.

The following individuals and websites have been nominated for their efforts to continue to spread the gospel of cryptocurrency to the masses.

Finematics, Cointelegraph, CoinDesk, Laura Shin, Blockchain Brad, Sari Azout, Hashoshi, The Defiant, DeFi Dad, Benjamin Cowen, Dapp University, Girl Gone Crypto, Jason Choi, Today in Defi, Alex Saunders, Blockchain Chick, Super Massive, Bankless

2) Incentivize

The individuals and communities we have identified have likely seen every trick and airdrop strategy under the sun to try and get them involved in other projects.

While we must acknowledge that no amount of incentives or capital can make certain people care about what we are doing, we want to structure our incentives in a way that gives those individuals who do care enough with adequate opportunity and ownership to hopefully get involved.

Distribution Structure

Utilizing the power of KPI Options from UMA, 10M XIO tokens will be locked in the UMA protocol and 100 XIO Options will be minted.

With 100 XIO Options in total, the nominated individuals & communities are eligible to claim 1 Option each. As there are more nominations than tokens available, these tokens will be redeemed on a first-come-first-serve basis.

- DAOs + Communities (40)

- Builders + Catalysts (67)

- Content Creators (18)

Key Performance Actions

For Communities and DAOs, the Option token is fully unlocked. For everyone else, half the token remains locked until certain Key Performance Actions (KPAs) are met.

To unlock the second half of their token, nominations can offer five hours to the Blockzero Advisory Board or propose alternative methods of agreement. The focus of these meetings is to help us grow the project and tackle some of the biggest obstacles/challenges we face at Blockzero.

Option Valuations

Every 1 XIO Option is worth up to 100,000 XIO.

The percentage of those XIO tokens that are redeemable is equal to the percentage of how close our Vortex TLV reaches the goal of 100k ETH. For example:

30% of TLV = 30,000 XIO tokens that are convertible per 1 Option

The percentage of TLV = (Current Vortex TLV / 100,000 ETH)

At the time of writing this, one XIO Option token is worth roughly $172.92. If the market cap of XIO becomes equal to the TLV of the Vortex at the time we hit our primary KPI, one Option would be worth 250 ETH ($625,000).

Options Expiration

While the Option tokens can be converted to XIO at any time, the Options expiration date is set for January 1, 2022.

3) Involve

If our north star and KPI for this experiment is 100k ETH, how do we get there? It is one thing to have a goal, it is another to have a plan.

Below are six primary mining campaigns any individual reading this can join in on with Advisory Mining reserved for nominations only.

- Advisory Mining

- Liquidity Mining

- Mental Mining

- Recruitment Mining

- Talent Mining

- Explorer Mining

Advisor Mining

Advisor Mining is one of the two newest programs we have at Blockzero. In short, individuals who are nominated can trade their time to advise our project in various ways unlock their full XIO Option token.

Advisors can unlock their remaining XIO Options token through a course of five Advisory Hour meetings with the Blockzero Council.

Some of the various topics we are currently seeking advice for are:

- How do we properly structure our DAO to operate in a more efficient manner?

- What is the line between centralization and decentralization?

- Are we currently overpaying for certain mining programs? If so, how should we restructure?

- What is a good indicator we may need VC capital to scale?

- Where is the best place to find and attract new developers into our ecosystem?

If you would like to set up your Advisory Hours, direct message Zachary Dash on Twitter.

Liquidity Mining

Liquidity Mining is our longest-standing mining program dating back to 2019. Participants in our XIO Liquidity Program (XLP) can earn up to 90% APY by following these instructions.

Note, the XLP will likely be transitioning into a more automated system in the coming months as participants will stake liquidity directly into the Vortex.

Mental Mining

Mental Mining can also be thought of as governance mining. On a weekly basis, sometimes 2–3 times per week, we host #XIOfeedback campaigns.

When you see this hashtag, if you dive into the discussion and provide some mental effort on the topic at hand, you can earn up to $1500 a month in the form of XIO tokens.

To learn more, go here.

Recruitment Mining

Recruitment Mining is another program that is new to Blockzero. In short, if you help recruit certain projects or talented individuals to the project, you can get compensated for your efforts.

For example, if you refer a project who gets accepted into the Blockzero Accelerator, you can earn $2000 in XIO tokens.

A more formal article with other Recruitment Mining opportunities will be made public in the weeks to follow.

Talent Mining

Talent Mining is the process of offering your skills, talents, or abilities to join the Blockzero Core in exchange for XIO tokens.

These skills can range from operations and development, to support and marketing. If you would like to apply to join the Blockzero Core, join our Discord and follow the instructions.

Explorer Mining

While these are some of the ways to get involved, Blockzero is truly a create your own adventure book.

If you are not sure of what value you can offer Blockzero, but you still want to get involved, we have created a Blockzero Explorers program — a 30-day opportunity to earn $1000 and explore what it’s like to work at Blockzero.

If you are interested in the Blockzero Explorers program — email John or Telegram @ johnvelasco.

Behind the Experiment

While this is an experiment, it is not without research. Below is a little insight on the historical evolution of crypto “growth hacking” — the good, bad, and ugly — and what items from this we have chosen to incorporate.

The Evolution of Crypto Growth Hacking

Marketing your project is hard.

Doing it with a limited budget, in a crazy noisy crypto industry, all while trying to withhold some semblance of a moral compass?

Damn near impossible.

From running CMO for a crypto marketing agency in 2018 to building three projects in the space since then, the creator of Blockzero has seen every “growth hack” trick in the book.

Here are three of the most commonly used tactics and potentially negative side-effects that follow.

- Influence and Shill

Influencer marketing is one of the oldest tricks in the book. Find someone with influence and get them to talk about your project.

However, there is a large spectrum of ethical and unethical ways we have seen these campaigns in action.

From influencers charging $100k to tweet about the project and dumping tokens on their own audiences, to simply not disclosing the relationship they have with the projects, these types of campaigns have formed a large spectrum of ethical and unethical behaviors.

Unless a project is able to find a high integrity influencer who truly believes in their project, many times these campaigns can have long-term negative implications.

If a shady influencer gets hold of your project, projects are likely to see a community overtaken by “gem chasers” and token hoppers. The faster they flock, the faster they jump ship.

This process gives an initial bump of energy, followed by the long-term realization that this noise has infiltrated your culture.

Not all influence is created equal.

2) Drop it Like it’s Hot

Starting to gain popularity in 2017 and beyond, airdrops were all the rage. The premise is simple: given away tokens and hopefully, some of those people will learn about your project.

Airdrops are not something new created by crypto. People and companies have been giving away products and services for as long as capitalism has existed.

At the bottom of the bear market of 2019, we did an airdrop our own by giving away the world’s first self-destructing currency. However, instead of holding an ICO and giving away a small portion of tokens for marketing purposes, we gave away 80% of our tokens on day one.

While this strategy definitely helped us get off the ground and attract the attention of many individuals from around the space, there are many negative implications of this strategy.

First, you must accept that your token is going to get diluted to people who may have offered little to no value to your project.

- A majority of the people will dump their tokens immediately.

- Some will hold onto it and feel entitled to the decisions to make as a project.

- If you’re lucky, a small subset of people will appreciate the drop, look into your project and get more deeply involved with what you’re doing.

The airdrop marketing strategy saw a newfound surge in 2021 with many top projects dropping their native governance tokens to the world for free.

$UNI may be the most impressive of the bunch with an average value of over $17,000 at peak prices.

3) Howdy, Partner.

Partnerships can be a great catalyst to grow a project. Even if they aren’t real, unfortunately.

Over the last year, we have seen a rise in the market for faux partnerships where two companies swap logos and make big “announcements” with their communities.

While this has been shown to trick many audiences and retail investors into thinking something big is happening, there are many times no actual increase of fundamental value for the projects involved.

Although there may be a time and place for the three above examples, we must also acknowledge that these “growth hacks” are often trading long-term value for short-term rushes of speculators, hopium, and artificial value.

The 100k ETH Experiment we have structured is our attempt to grow Blockzero while removing the downsides but retaining the ethical and aligned side of growth marketing.

Follow the Experiment

This wouldn’t be a true growth marketing experiment without the proper testing, observation, and reporting.

If you want to follow this growth marketing journey, we will begin making updates of the experiment directly here on medium. We will report on:

- Increase or decrease of TLV

- Nominations who have joined and their contributions to the project

- Wins, losses, and learnings along the way

If you would like to stay updated, text ‘100k’ to +18444864400.

FAQ

This is a live and evolving list of questions. If you have questions yourself, feel free to join our Discord.

What is the Vortex?

The Vortex is a decentralized venture fund.

Currently, in the second stage of development, the Vortex currently holds roughly $15M at the time of writing this.

Why did we choose the Vortex TLV as our KPI?

The vision of Blockzero is to build, launch, and scale ideas into the decentralized world. Our best metric to see how well we are doing this is the TLV of our Vortex.

The Vortex is a collection of all the projects we have created or accelerated. If the TLV increases, it likely means we are helping these projects have greater impacts on the world.

While we were originally wanting to use TVL (Total Value Locked) for our primary KPI, we ended up using a less commonly used term — TLV (Total Liquid Value).

The TLV is simply the amount of ETH we could acquire if we liquidated all our positions.

We chose TLV for two primary reasons.

- TVL (Total Value Locked) can be gamified if a bad actor were to pump the price of a low liquid coin in our Vortex.

- TLV (Total Liquid Value) incentivizes participants in the experiment to increase the liquidity of our assets under management.

Total Liquid Value Breakdown

A widely used metric to compare different DeFi protocols is Total Value Locked (TVL). For our 100K ETH experiment, we chose a different, more pragmatic metric representing the actual utility of the assets locked in the Vortex: TLV or Total Liquid Value.

Total Liquid Value is determined by simulating the market selling all Vortex’s assets to ETH.

How do we increase the TLV?

There are three primary ways we can increase the TLV:

- We create projects in the Blockzero Studio and deposit their native tokens into the Vortex as we did with Flashstake

- We accelerate projects in the Blockzero Accelerator and deposit their native tokens into the Vortex as we did with the UMA protocol.

- We increase the liquidity or value of the assets currently in the Vortex.

Vote

To set this experiment in motion, a vote will need to be passed by the Blockzero Citizens. This vote will take place from June 17th to June 24th on our governance page.

Livestream

A live stream hosted by Zachary Dash to discuss this proposal will start at 5pm UTC on Friday, June 11th.