Today we are announcing an XIO Liquidity Pool on Uniswap that allows you to double your $XIO holdings in as little as six months. Here is a breakdown of the rest of the article.

- What is the XIO Liquidity Pool on Uniswap?

- How many XIO Rewards Can You Earn by Participating?

- What are the Requirements to Be Eligible?

- How do you join the XIO Liquidity Pool?

- How do you withdraw funds from Uniswap?

- How do you withdraw XIO Interest?

What is the XIO Liquidity Pool on Uniswap?

For those of you who aren’t familiar, Uniswap is the greatest addition to the cryptocurrency world since the evolution of Vitalik memes.

Instead of depending on an exchange for liquidity, anyone can create a decentralized exchange (swap) directly on the Uniswap platform. You control your crypto at all times.

While this is an amazing technology, it still takes many people participating to become beneficial or helpful to the XIO Network.

For this reason, we are creating an incentivized liquidity pool on Uniswap and rewarding you, XIO Citizens, for helping bring it to life. Below is a breakdown of how much XIO you can expect to make for participating and how to get involved.

What do you get for Participating?

This took some internal debates on what the best rates would be. If the rate is too high, you can dilute the market. If the rate is too low, nobody will participate.

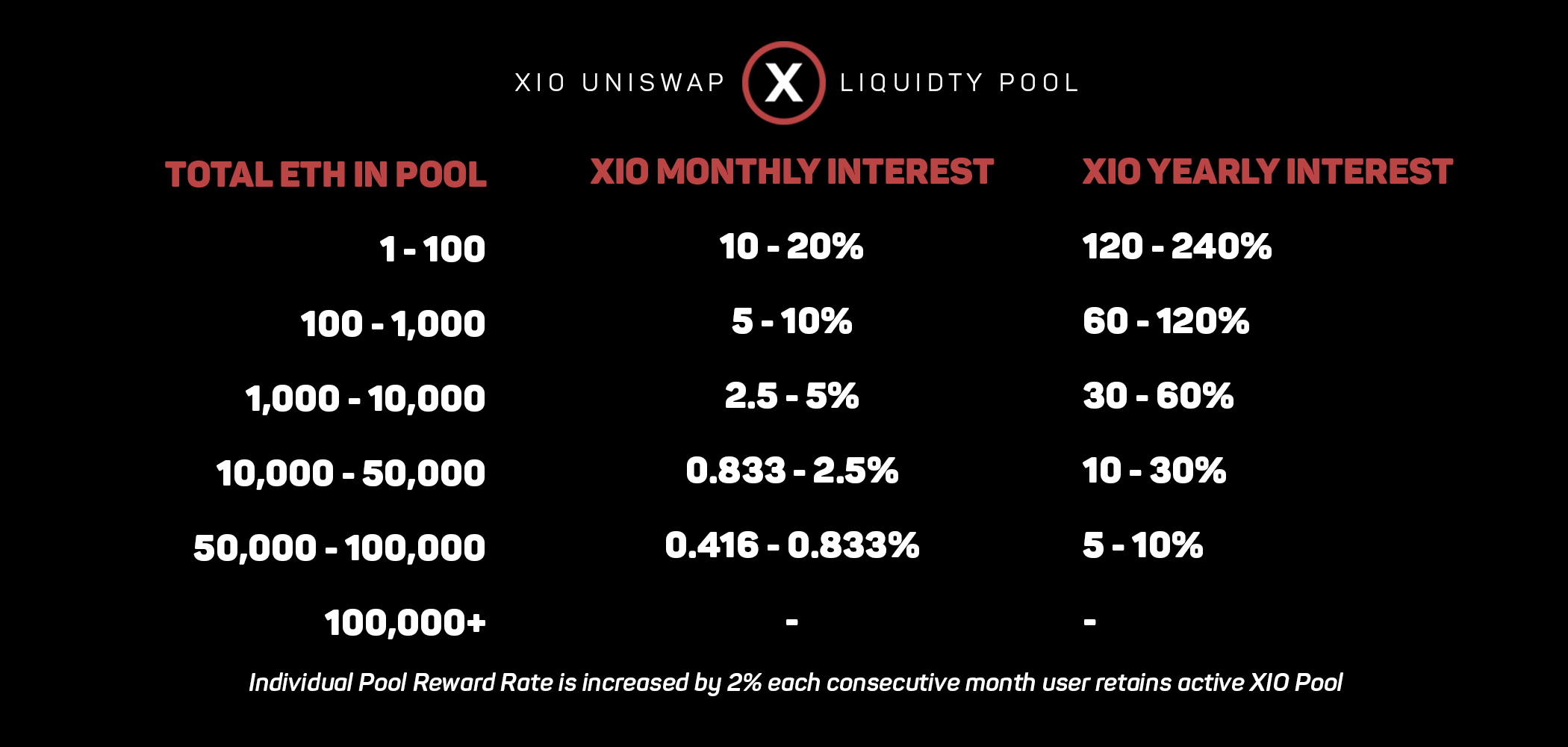

To capture some early momentum, XIO Rates are adjusted based on how many ETH is in the pool. These thresholds are at 100, 1000, and 10,000, 50,000, and 100,000 ETH. Our goal is 100,000 ETH.

As you can see from the above graphic, there is a large incentive to join the Pool early. Over time, as the pool grows, the interest rates will decrease.

We didn’t want to overload this visual, so we created a separate public Google Sheet with more numbers and estimated rates over time. Click here to view. This google sheet will also be updated monthly with whitelisted ETH addresses of all individuals participating.

XIO Bonus Rewards

More than thresholds of ETH, we have bonus opportunities for those who keep XIO in the Pool for longer periods of time. For each month you have an active Pool, you will gain an extra 2% interest per month (max of 10% bonus per month)/

If you remove any amount of XIO or ETH from the Pool for any reason, your XIO Bonus is reset at the Standard base rate.

Uniswap Bonus Rewards

Uniswap has a 0.30% fee per trade. These fees are actually given to liquidity providers! This means, if you are providing liquidity to XIO and there are a large number of trades, you will earn a percentage of those fees based on how much of the pool you manage, Pretty cool!

What are the Requirements to Be Eligible?

We made it pretty simple and straight forward to be eligible to participate. There are only two requirements.

- The minimum amount you can stake is 1 ETH

- Your XIO Address must be Whitelisted by filling out this Typeform

How Do You Participate in the Pool?

If you have read this far and are interested in participating, here is a step by step walkthrough on how to get started! You can also watch the video at the top of this article for more instructions.

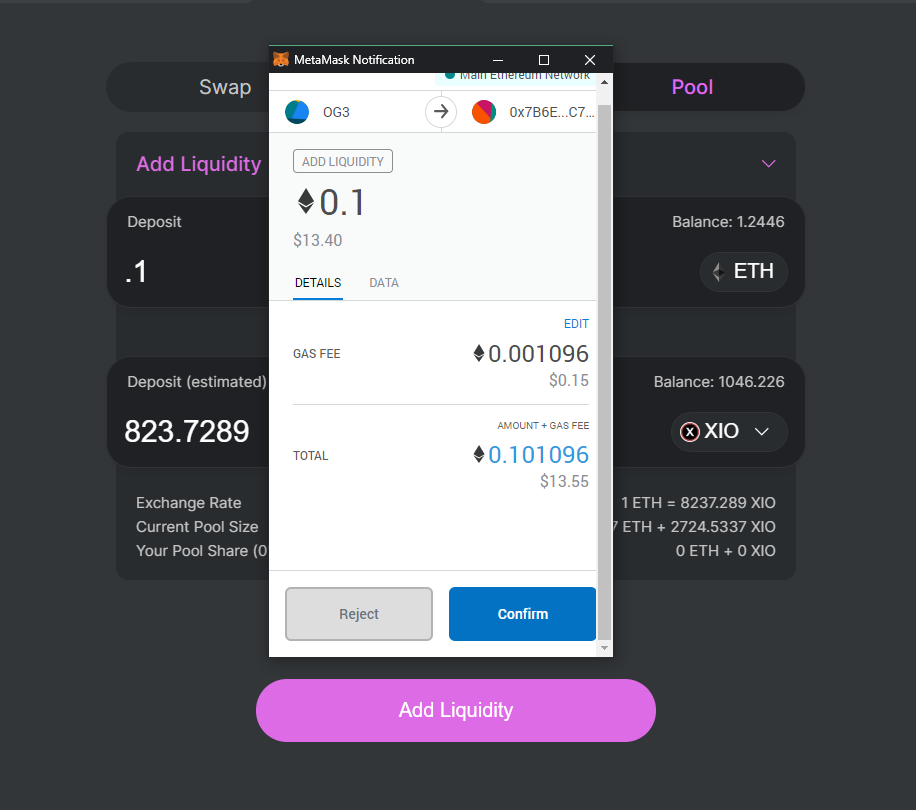

Step One | Go to Uniswap.Exchange

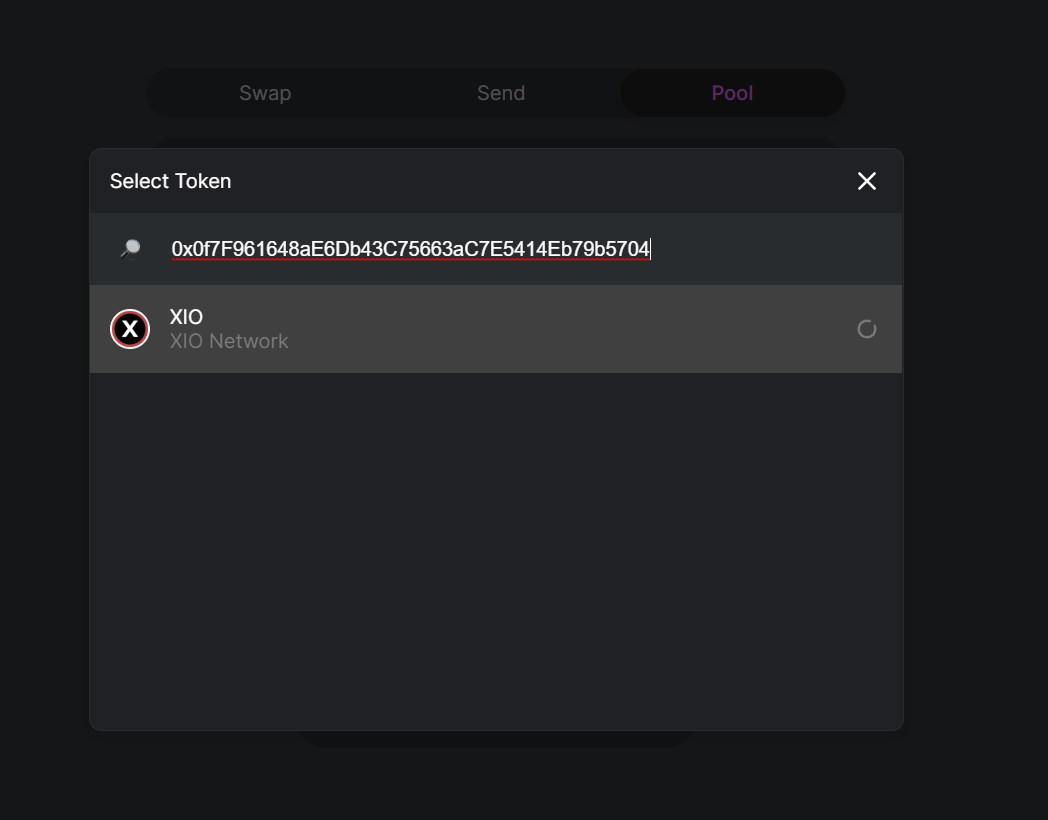

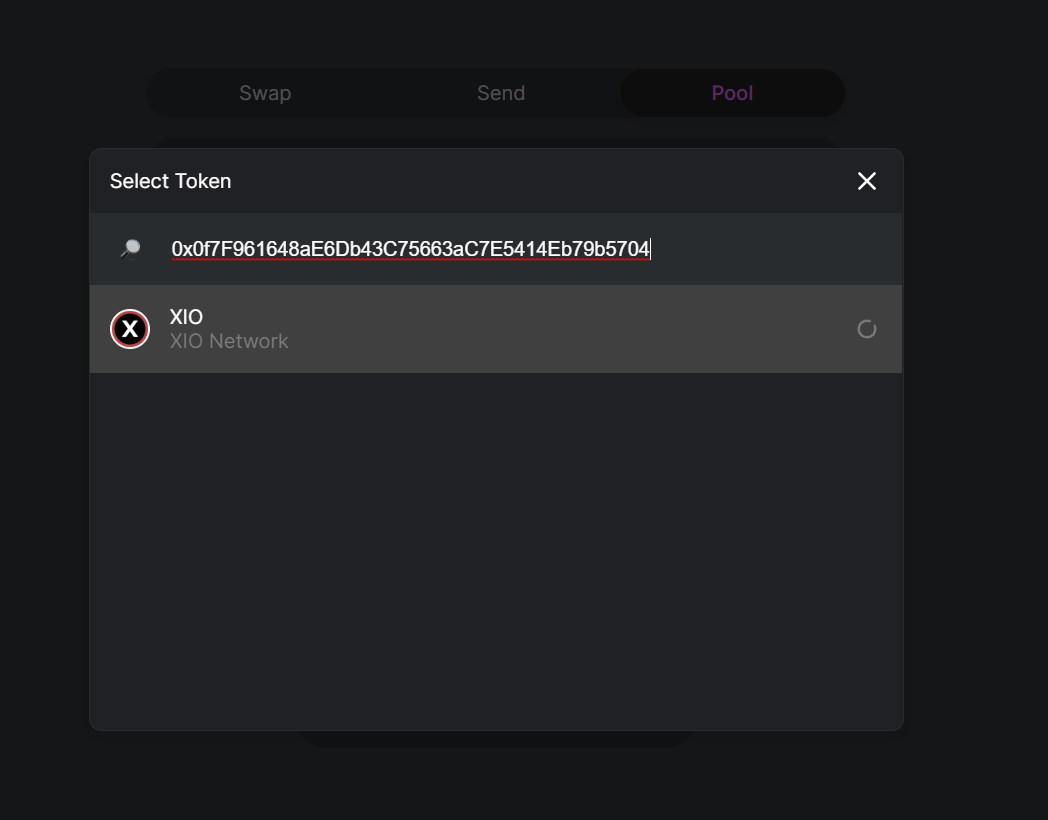

Step Two | Click Pool + Select Token XIO

Step Three | Unlock XIO + Enter Desired Amounts

How do you Withdraw Funds from Uniswap?

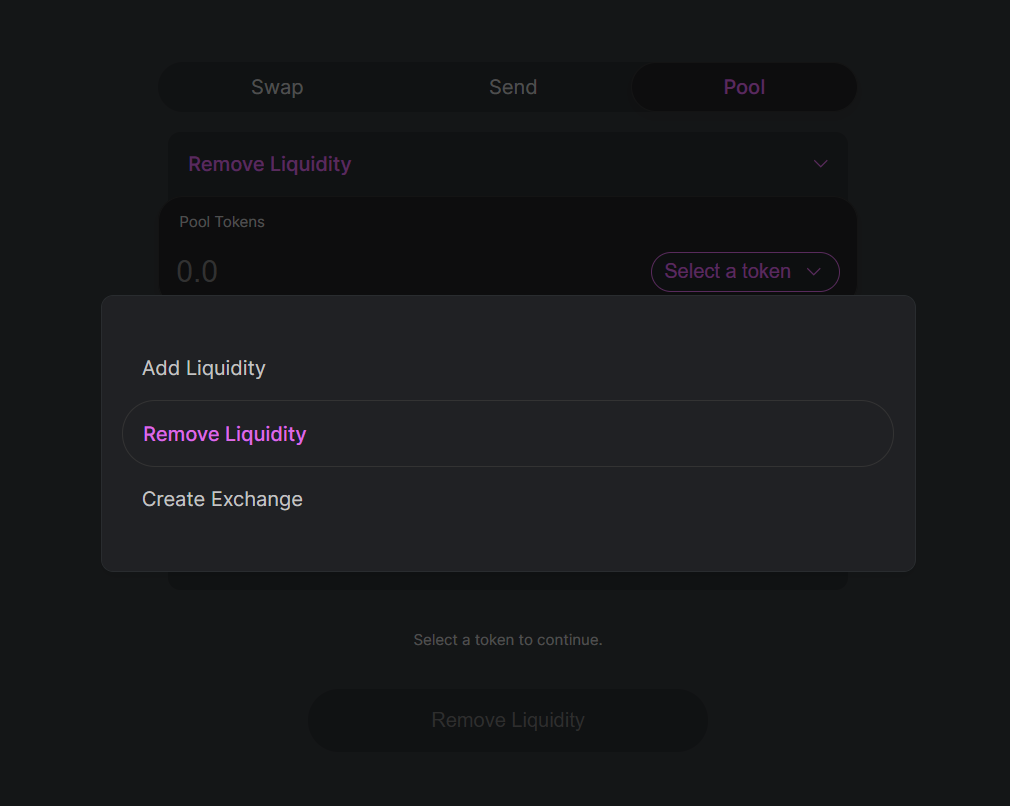

One of the best parts about Uniswap is you can withdraw funds at any time. When you are ready to withdraw your liquidity, you simply go to the ‘Pool’ tab and click “Remove Liquidity”.

Keep in mind, if you remove any tokens from the Liquidity Pool at any time, your XIO Bonus reward rate is reset back to standard.

How do you withdraw XIO Interest?

Keep in mind, you don’t earn XIO Interest directly from Uniswap. All interest earned must be requested using the official XIO Withdraw Typeform.

To be eligible for Withdraw, you must submit your request before the 1st of the month. Interest is paid out between the 1st and 3rd of the month after you submit a request.

For example, if you submit an XIO Interest Withdraw request on December 28th, you will receive your XIO Interest sometime between January 1st and 3rd.

Disclaimers

- First and foremost, we don’t control Uniswap. While it has over $23.7M currently locked into its smart contract and used across the industry, it is still a technology built on a smart contract. We at the XIO Foundation have no control over lost funds to Uniswap.

- This is extremely important to understand. The ratio of funds you put into Uniswap Pool may NOT be the ratio you pull out. For example, if you put in 1 ETH and 1000 XIO, this does not mean you will get 1 ETH back. While you are always guaranteed to get an equal amount of USD back out, the ratio of your withdraw may fluctuate with market dynamics. If you put in $100 of ETH, you may get $90 of ETH back (with $10 XIO) or vice versa.

- Uniswap liquidity pools can be highly volatile during early-stage tokens. Please watch this video if you want more understanding of how they work behind the scenes.

- The XIO Foundation has the ability to change interest rates as needed. If changes are to be made, we would attempt to give at least a 15 days notice.

Conclusion

When most people ask “when to exchange?” they are really asking “when liquidity?”.

Although we are not opposed to exchanges as we grow, our main priority is liquidity for our XIO Startups, Citizens, and Partners so we can launch ideas into the decentralized world.

The best thing about Uniswap to us is interdependence from exchanges. Instead of being at the mercy of centralized authorities, we believe Uniswap will allow us to control our own destiny and not rely on third-party providers.

We are excited for this next chapter of XIO. As always, reach out to us on Telegram from live chat questions and discussions.