For those of you who have been with us since the beginning of Bomb Token, you know our affinity for deflation and tokenomic theory. In creating the world’s first self-destructing currency; we learned a lot along the way.

Many of our community members were surprised that XIO was not deflationary at the launch. This decision was a difficult but intentional choice to ensure we were not burning tokens just for the sake of deflation. We wanted to first clarify our goals, discover our objectives, and solidify a vision before making this decision.

Today, we believe we have gained clarity on how to ensure a long-term, sustainable, mutually aligned and incentivized token model. To help us support and launch startups into the decentralized world for decades to come, XIO is implementing a deflationary buy + burn token model.

What is the Current Business Model?

From the beginning of XIO, we have used YCombinator as a way to explain our business model.

YC is a startup incubator in Silicon Valley that is behind some of the greatest tech companies of our era including DropBox, Coinbase, AirBnb, and Stripe — just to name a few.

Their model is pretty simple; give companies capital and get 7% equity of the company in return. At this time, the cumulative valuation of all their companies is $155,000,000,000+.

How is XIO Different?

While the YC model has proven to work, we believe it does not completely align with the obstacles and opportunities currently within the blockchain industry. For a separate article on these differences, go here.

Instead of taking equity from startups, all upside and potential value for XIO is generated through the form of native tokens. When a startup joins the incubator, they lock their native tokens in a decentralized XIO Portal.

Any user (XIO Citizen) who wants to participate in this Portal must provide a form of value to the startup. This ‘value’ can be a variety of things and is chosen by the startup.

For these efforts and value creation for the startup, native tokens are unlocked from the Portal and rewarded to Citizens.

How Does XIO Generate Revenue?

While XIO has a larger vision of running completely decentralized, there is an XIO Foundation to help facilitate and foster the ecosystem (similar to the Ethereum Foundation).

To incentivize these efforts, the XIO Foundation was awarded 25M out of the total supply. In the same system that Citizens use to support startups, the XIO Foundation can participate in these Portals and earn native tokens.

To survive and grow, the XIO Foundation must provide value and growth to startups just like everyone else. This is how “income” is currently generated.

The Power of the Citizens

While the current model can be considered sustainable, we don’t consider it optimal.

The entire success and value of XIO revolves around the efforts of Citizens. If Citizens are demotivated or not properly incentivized, the startups that open portals will not be successful. This positive (or negative) feedback loop truly showed us that without proper incentives for Citizens, the entire model will be hard to scale.

Why Do We Want to Implement Deflation?

To encourage growth and engagement, the XIO Foundation has created multiple reward opportunities that Citizens and Startups can use to earn tokens. These include:

- XLP: Earn 10%+ per month for adding liquidity

- XSI: Earn 10%+ per month for staying social

- xInsider: Earn 1% per month for joining SMS list

- xIncubator: Earn 2% per month for XIO staked into Portal

Although these incentives have helped us get off the ground, we believe these early increases to Circulating Supply may create downward pressure on the XIO token.

What is the Solution?

While the XIO Token has proven to be an amazing crowdsourcing utility in terms of increasing overall engagement, it has not yet proven to be the best crowdfunding mechanism.

With all-new tokens, there is an early phase of awkward teen years where the asset is finding its value and maturing into a liquid asset. The early volatile nature make the XIO token (currently) not the best solution for our startups.

To counteract these potential obstacles, mutually align Citizens, and provide a model for potential value accrual for the entire Network over time; we are currently developing a Buy + Burn mechanism for XIO utilizing the power of Dai.

How Will DAI Be Utilized?

DAI is a decentralized stable coin built by the team at Maker DAO. We believe it has many of the characteristics we as the XIO Network need to properly help our startups attain a steady flow of capital.

- Liquidity: DAI has a $100M+ Market Cap

- Stability: DAI retains its value at $1

- Interest: DAI currently provides 6% yearly interest

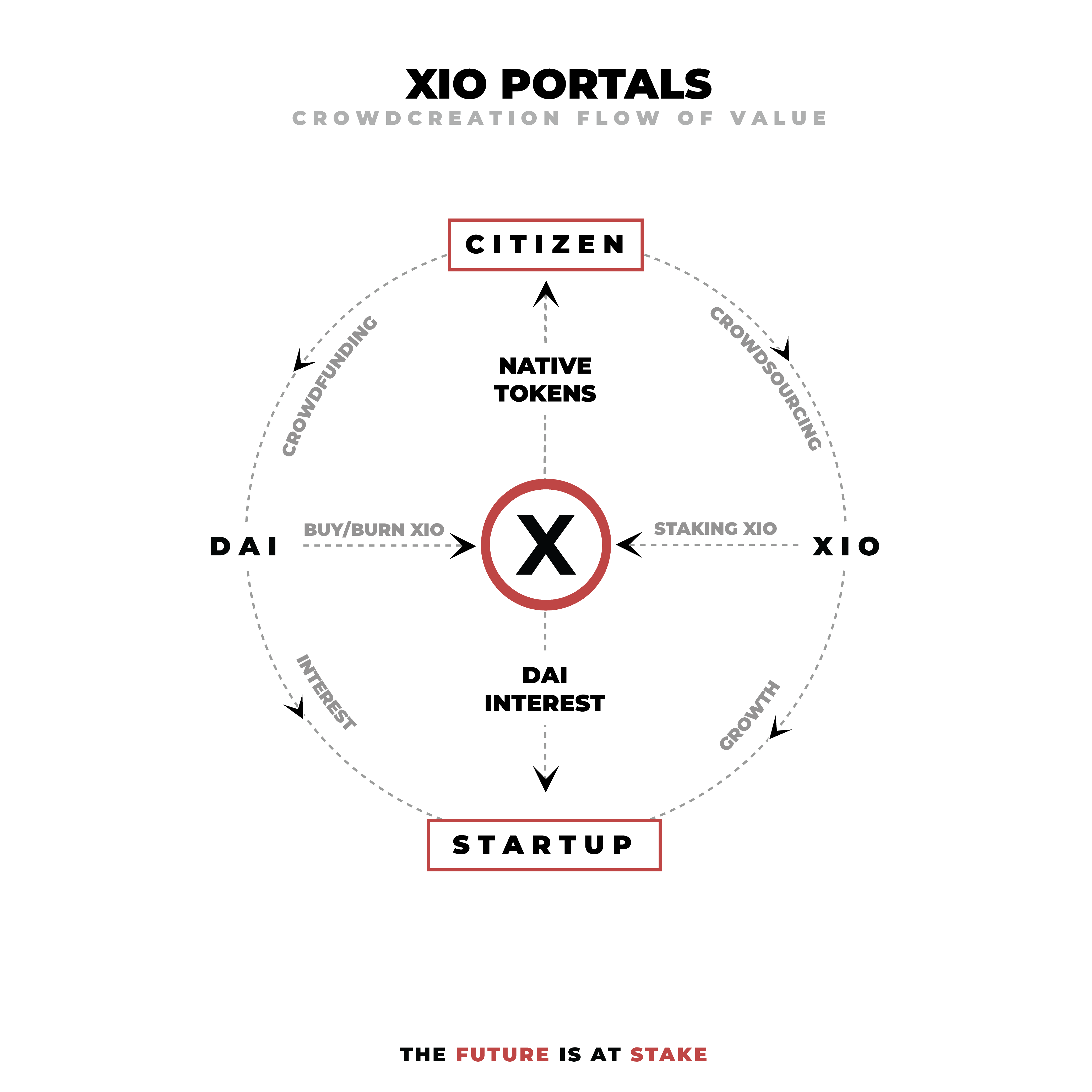

When a startup activates an XIO Portal, they will be able to accept both XIO and DAI as staked assets.

- Staking XIO will be focused on crowdsourcing or growth for the startup.

- Staking DAI will be focused on crowdfunding for the startup.

What Does This Mean for XIO Holders?

This is where it gets interesting. For every DAI that is generated through the crowdfunding system of the Portal, a portion of these funds will be used to buy and burn XIO Tokens.

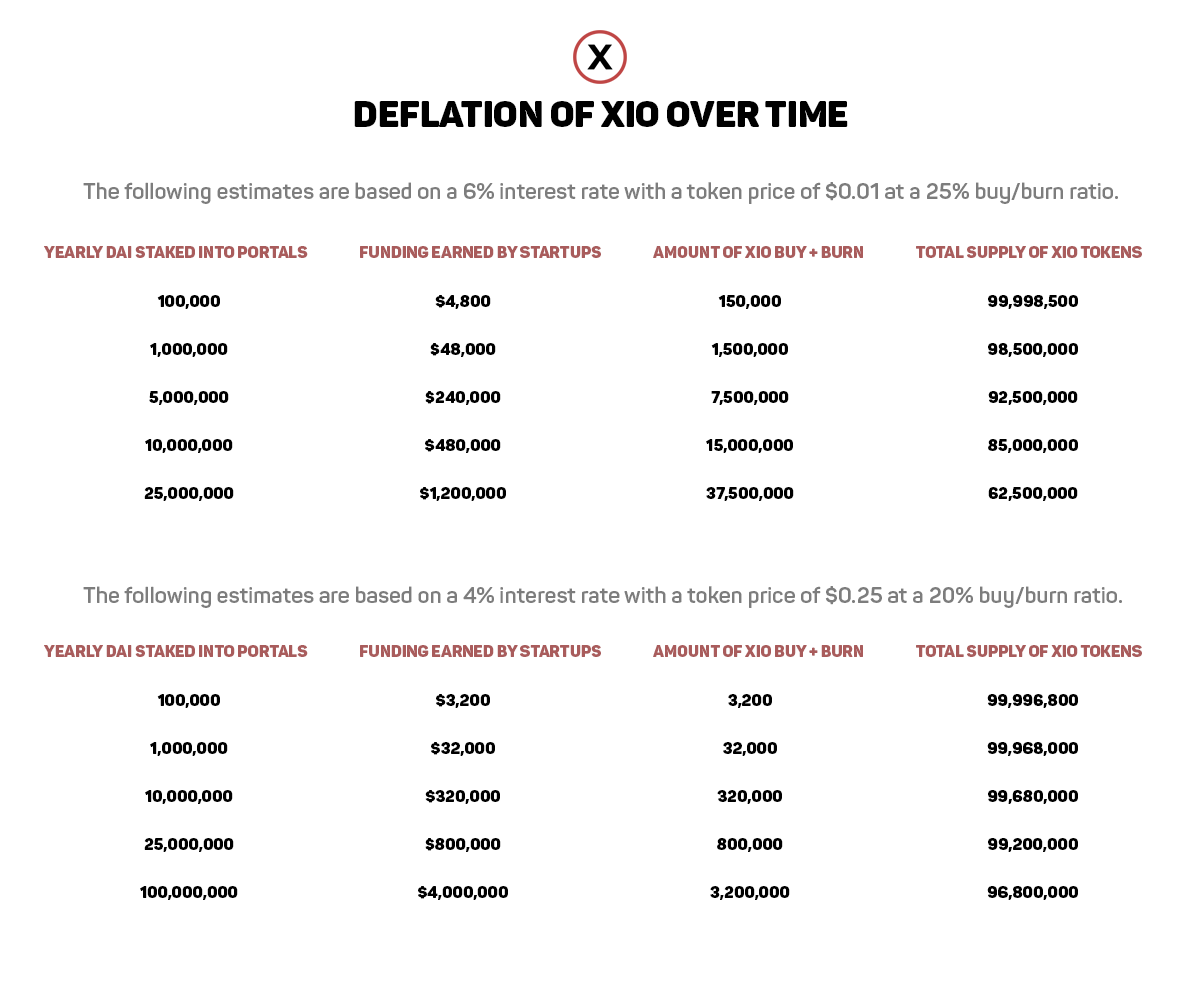

Below are some examples and a calculator to estimate how the total supply of XIO Tokens will be impacted based on how much DAI is staked and what the price of the XIO Token is. In short, the more DAI that is staked, the less XIO there is in existence.

Below is a visual flow of how tokens + value are circulating within this model. It is important to note that Citizens will retain access and control of the tokens (XIO + DAI) at all times.

Conclusion

The system for staking of XIO from Citizens will not change at all. The only difference that XIO Token holders will see is a constant reduction of Total Supply overtime that is proportional to the growth and success of the entire Network.

While it has already been a crazy ride to this point, we could not be more thankful for the amount of continuous feedback, engagement, and positivity our community has shown over the last several months.

Let’s Keep the Momentum Going. The Future is at Stake.