The Time Value of Money (TVM) is a straight forward concept:

The Time Value of Money (TVM) is a straight forward concept:

Money you have now is worth more than the identical sum in the future due to its potential earning capacity.

While time traveling in the physical world is something still reserved for the adventures of Marty McFly, what if it were possible to time travel in the financial world? What if we could redeem money from the future, today?

The invention of Ethereum made all of this possible.

Article Overview

In a decentralized and permissionless manner, smart contracts allow us to manipulate money — but not just how we interact with it, but when we interact with it.

The remainder of this article will:

- Rise: Give an overview of the two new time-based protocols growing and experimenting within the DeFi industry

- Risks: Compare how they (currently) operate while breaking down the possible risk implications of each

- Roadmaps: Explore what the future of tokenized-time may look like given the current plans and trajectories.

A few disclaimers before we start

- Flashtake is a protocol developed out of Blockzero Labs — a project that I created. While I tried to be as objective as possible during this research and article, I wanted to transparently acknowledge the potential for my own personal bias here.

- As of last week, I am both a small holder and massive supporter the Alchemix project. While I was not aware of the protocol until recently, I think what they are building is extremely intriguing and am excited to see their progress into the future.

Alchemix ($ALCX) Overview

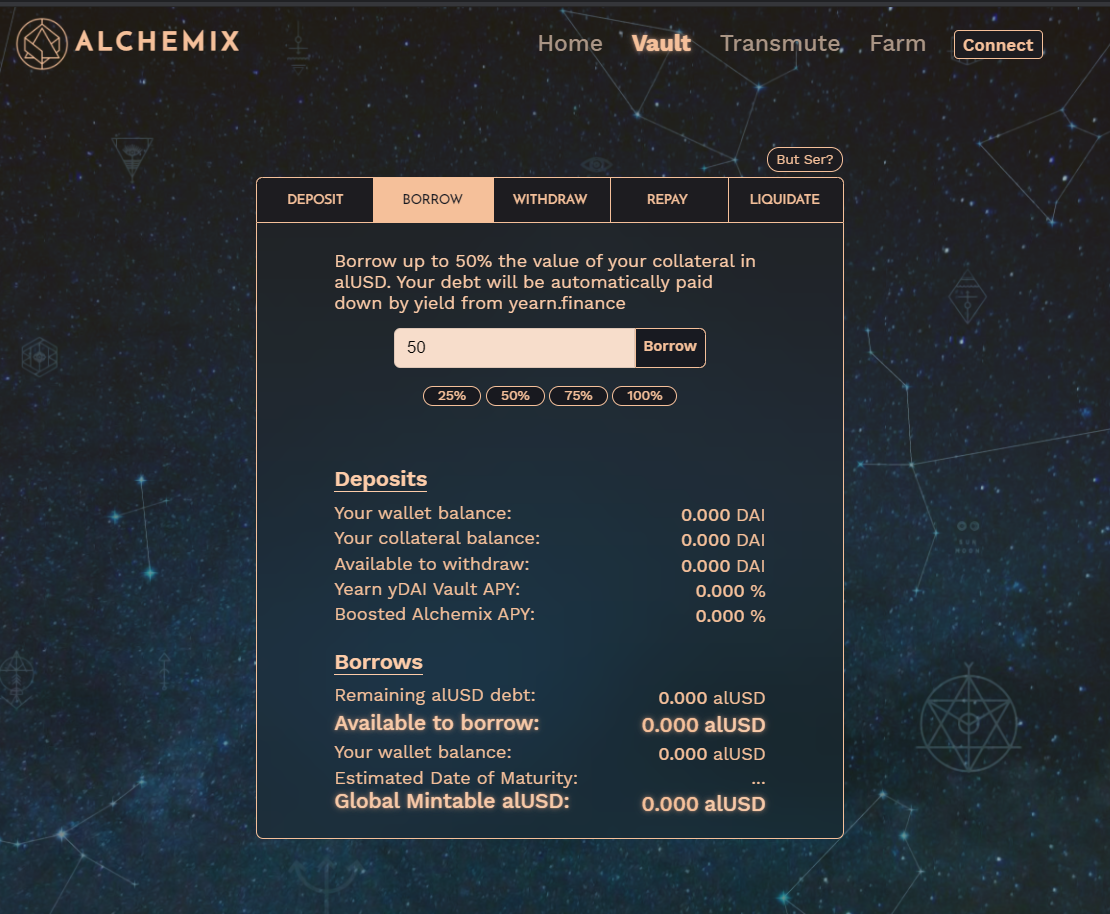

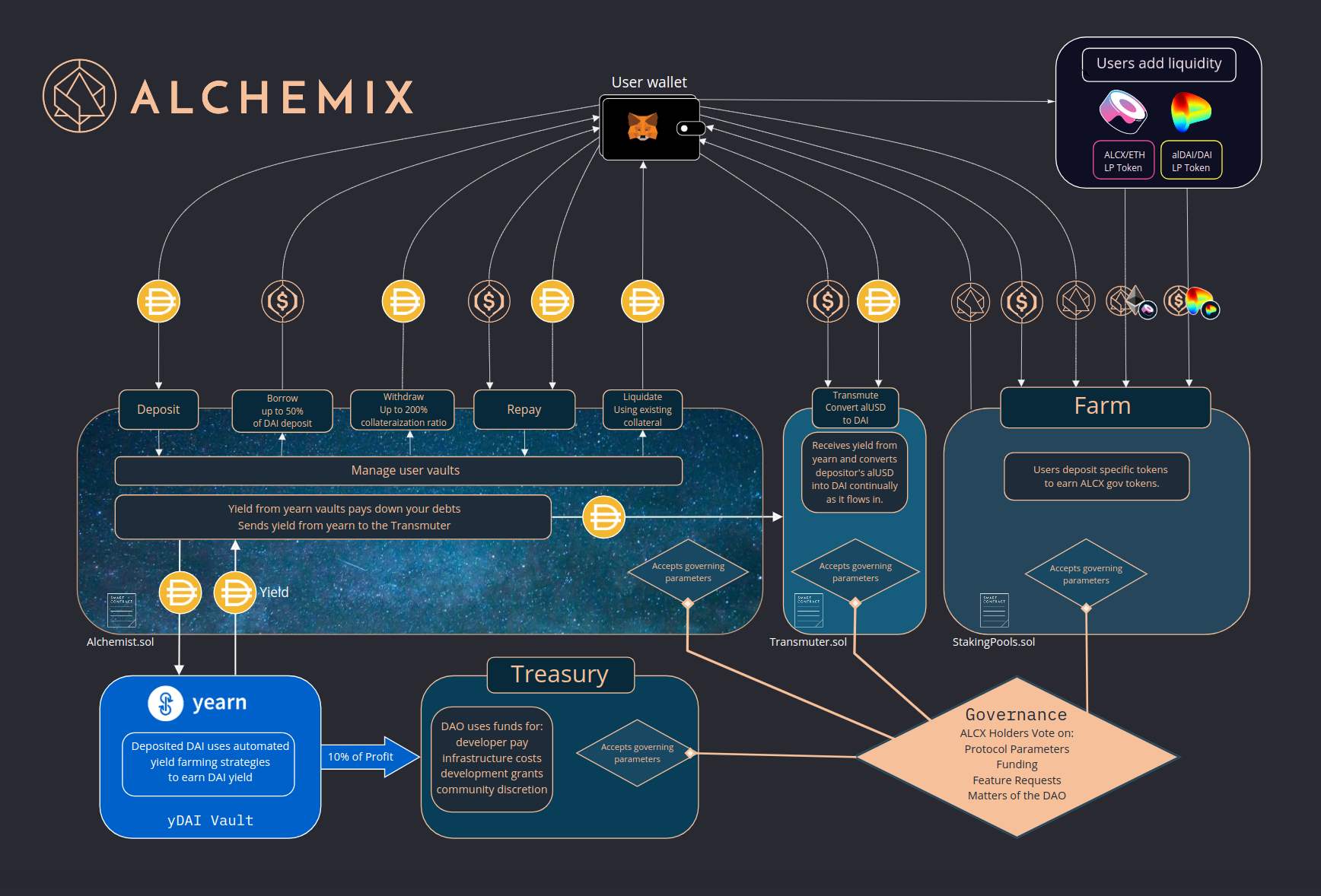

Alchemix positions itself as “The future yield tokenization protocol.”

In short, it allows anyone to lock up DAI and mint (up to 50% in value) of the alUSD token. The alUSD token is the native stable coin of the Alchemix platform.

It is similar to taking out a loan, however, the genius of Alchemix comes when you understand two things:

- You can’t be liquidated

- Your loan repays itself back over time

“Your only debt is time” — a great tagline.

Flashstake ($FLASH) Overview

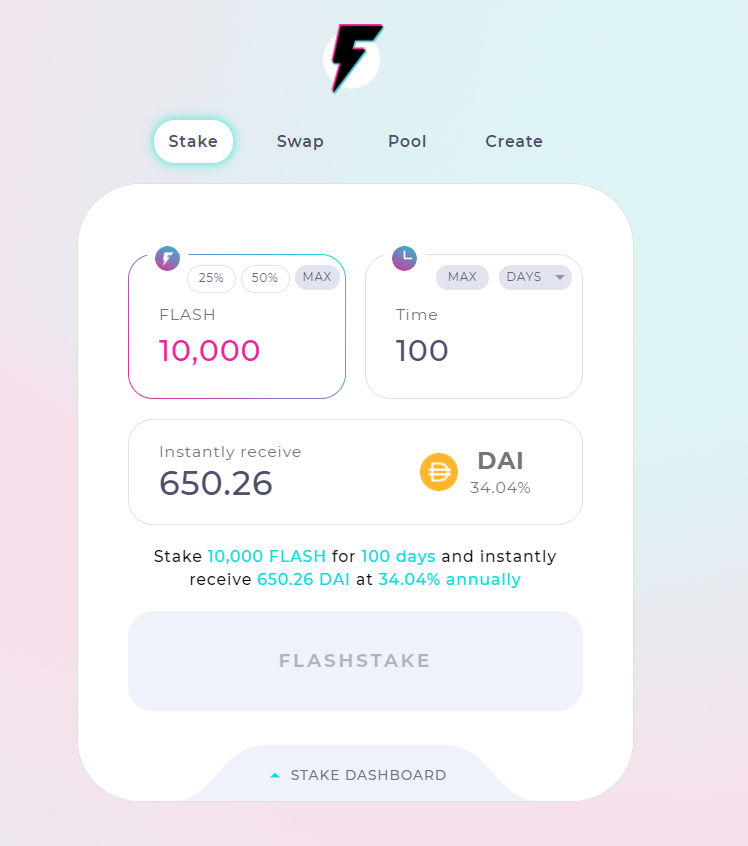

On the other hand, Flashstake positions itself as: “The time travel of money”

In short, users can stake $FLASH for a pre-determined amount of time and and instantly earn a variety of tokens like ETH, DAI, XIO, etc.

While the APY for the return is not limited, the average APY of the Dapp so far has hovered around 25–40%.

The same way that anyone can add pairs on Uniswap, anyone can add any ERC token they want to the Flashstake protocol in a permissionless manner.

Native Token:

- Alchemix (ALCX) $315M Market Cap — Token that grants governance rights in Alchemix DAO.

- Flashstake (FLASH) $9M Market Cap — Tokens needed to stake and earn instant upfront yield.

Inflation

- ALCX: Fixed inflationary emissions

- FLASH: Dynamic supply. Based on protocol usage. Only minted when tokens are locked into protocol. Tokens are burned if a user Unstakes early.

Distribution

- 20% Alchemix DAO Premine (5% reserve)

- 16% Private Staking/LP Pools for Founders

- 64% Public Staking/LP Pools

FLASH

- 100% Pre-mine to $XIO holders (Native token of Blockzero Labs)

- 0–20% Stake Reward match to Blockzero Labs (voted on by Citizens)

Funding

- Alchemix: eGirl Capital + Weak Simp Capital + DeFi Chad Ventures

- Flashstake: None (Build by Blockzero Labs)

Auditing

- Alchemix: Audits are pending. With as many companies and capital behind the project, we would hope this has to do with a backlog of available auditors more than anything else.

- Flashstake: Audit was performed by Solidified + multiple weeks of battle testing + bug bounty performed.

Alchemix Risks

- MakerDAO protocol failure (Unlikely)

- DAI off peg

- Alchemix protocol failure

- alUSD off peg

- Curve protocol failure

- Lowering of yield rates on Curve would = prolonged rated of loan repayment. If Curve yield gets cut in half during a bear market, borrows of alUSD must wait twice the amount of time for repayment.

Flashstake Risks

- Flashstake protocol failure

- Flashstake token volatility

- Decrease in usage/demand for native token

Alchemix Roadmap

- Ensuring the security of the protocol and future add-ons

- A wider choice of stable coin collateral types for alUSD

- Addition of currencies like ETH and wBTC to be used within Alchemix

- Additional dApps to expand the Alchemix ecosystem such as Alchemix based credit lines and more

Flashstake Roadmap

- Go here to read Five things to look forward to in 2021

- Upgrading to Optimism Layer 2

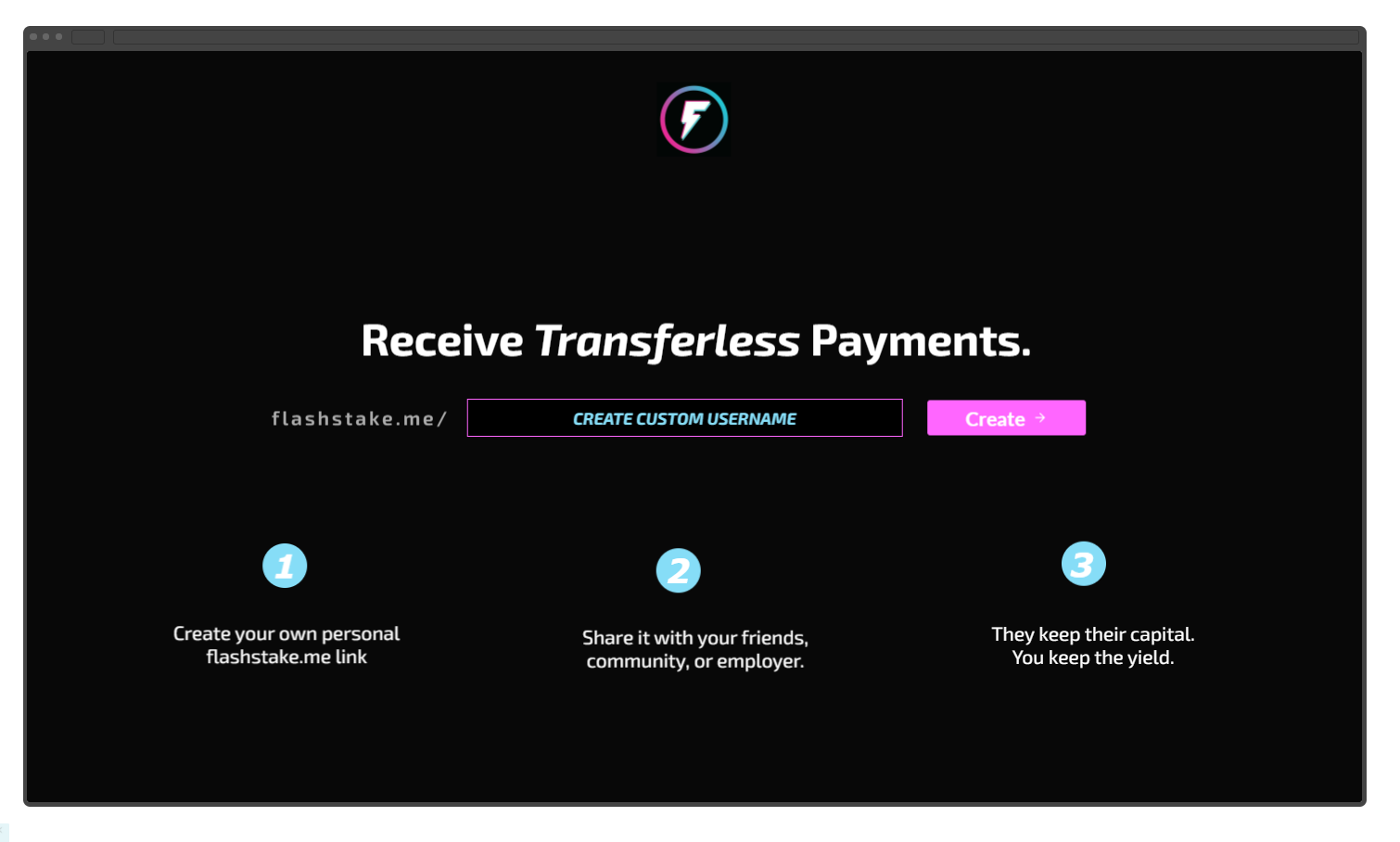

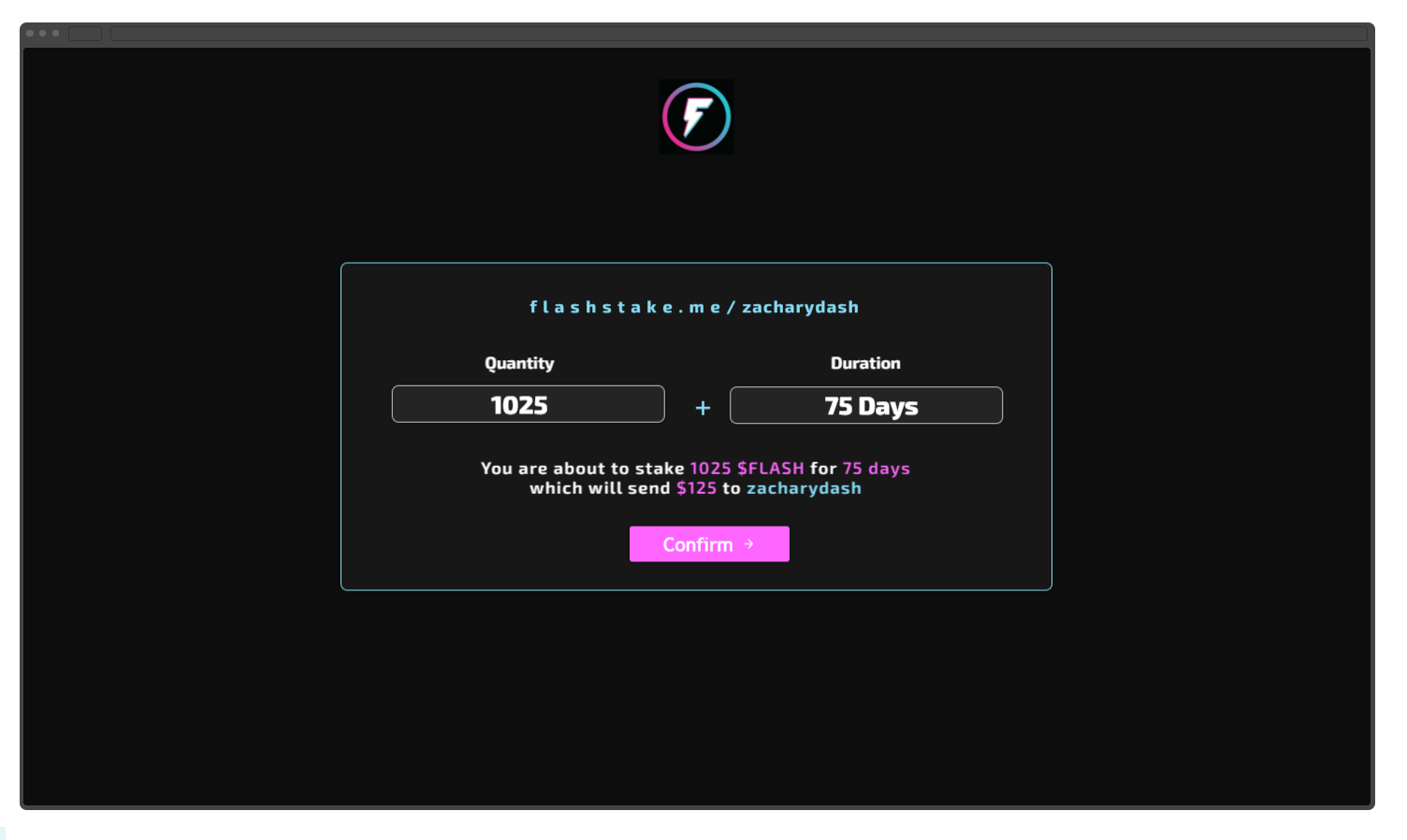

- FlashstakeMe: Venmo and PayPal give you a custom link to send to your friends for payment. FlashstakeMe is a platform that will do exactly this.

- The difference is, instead of having to send you money, they can simply Flashstake and redirect the yield to your wallet. They keep their capital. You keep the interest. Simple as that. FlashstakeMe would be the world’s first transfer-less invoicing system.

- Upgrade to Zynthetic: Imagine being able to Flashstake any token. Whether it be DAI for LINK or SNX for AAVE, the Flash Zynthetic Upgrade would make this possible. Since making this video, the community has spoken and decided to move Zynthetic under the Flash protocol umbrella, rather than have it be a stand-alone project.

The Future is at Stake

While these two protocols are attacking the space in two very different ways, it seems clear the industry is curious on exploring and experimenting with time.