In 2005, Y Combinator (YC) was born.

A startup accelerator based out of Silicon Valley, YC has helped launch over 2000 companies into the world including industry giants like Coinbase, Airbnb, Reddit, DropBox, Stripe, and Twitch — just to name a few.

As of January 2021, the combined value of all YC companies totals over $300 billion dollars.

Twice a year, hundreds of wide-eyed founders from all over the world fill in applications to be accepted into the exclusive club that is Y Combinator.

If accepted, startups receive the necessary capital, advisory, and resources to grow their projects. In exchange, YC takes on early stage equity of these startups.

Instead of being the creator of innovation, YC found exponential growth by being the catalyst for innovation.

The Cost of Exclusivity

Although the YC model has helped grow some of the most successful companies of this generation, 98% of applications are rejected.

This level of exclusivity in the application process may frustrate some, but the reasoning behind only accepting 2% of potential startups is not without logic.

- Limited Capital: There is only enough capital for YC to deploy

- Limited Talent: There are a limited amount of talented humans to help review, process, and advise these startups

- Limited Startups: There may simply be not that many good startups

While these limiting factors may be an expected trade-off for exclusivity, what happens when a sleeping giant like Shopify or Amazon falls through the cracks? What if the next Elon Musk was one of those 98% of applicants rejected?

The Sleeping Giant

Let’s rewind to July 2011.

A Russian-Canadian programmer began writing for a publication called Bitcoin Weekly that offered him 5 Bitcoin for each article he wrote.

This was worth $3.50 per article at the time — $300,000 as of today’s values.

Two years later, that same writer was inspired to publish the foundational white paper of a big, really big, idea: a world computer.

That person’s name is Vitalik Buterin and the white paper he wrote was for a project called Ethereum.

Unicorn Valley: The Ethereum-Effect

One popular term used in the startup space is Unicorn:

A startup valued at over $1B dollars.

At the time of writing this, Ethereum is responsible for over 29 Unicorns utilizing the ERC-20 standard.

- Uniswap: $18B

- Chainlink: $17B

- Synthetix: $3B

- Aave: $5B

- Compound: $2.5

Over $50B of financial assets are currently locked on Ethereum’s blockchain. However, more than the capture of value in the world, Ethereum enables the creation of value into the world.

In less than 6 years, Ethereum reached a market cap that of over $275B. Today, that is only $25B shy of the total value all YC companies combined.

The Catalyst for Creation

Once every few decades, a new technology is born that re-teaches us the power of exponential growth.

- 1990s: The invention of the internet enabled the creation of value at a scale never before thought possible.

- 2000s: The supplement of YC became the catalyst and helped the creations reach scale.

- 2010s: The invention of the Ethereum blockchain enabled the creation of value at a scale we never thought possible

Although the YC accelerator model has been innovative, the timing of the internet made it possible. In the 2020s, what will Ethereum make possible? What will be the catalyst for creation in the decentralized world?

The YC of the Decentralized World

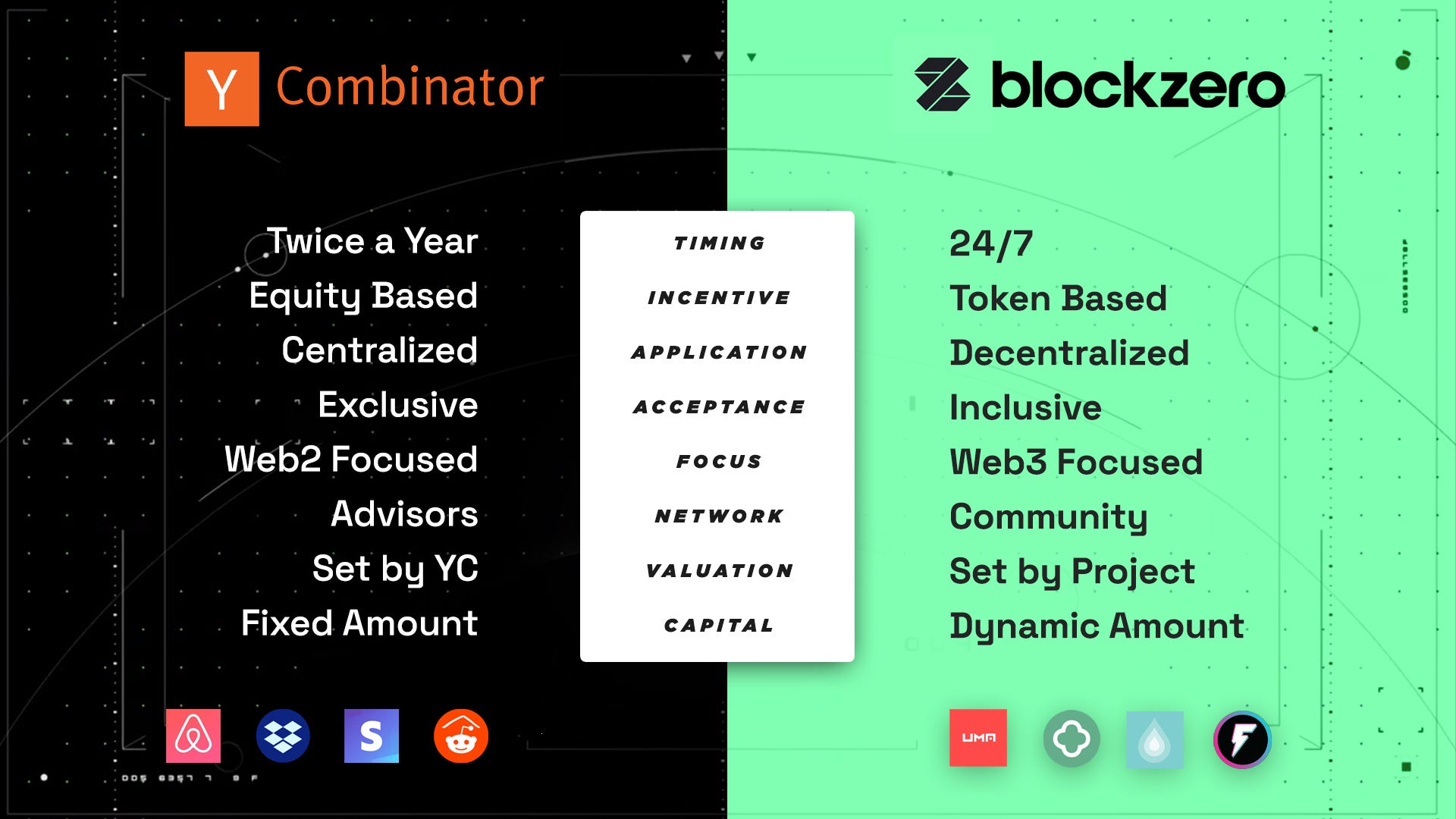

While Y Combinator will most likely go on to fund many great startups, the model simply does not align with the decentralized world.

Here are seven reasons we are building Blockzero Labs to be the YC of the decentralized world.

1) Permissionless Opportunity.

As mentioned earlier in the article, it makes sense why YC can only accept so many projects.

Similar to Harvard, Y Combinator must retain a high barrier to entry to remain an exclusive brand and ensure they can properly allocate resources (capital, mentors, etc) to the accepted startups.

However, this exclusive mentality limits the long-tail of innovative minds from around the world. If there is one thing that the invention of blockchain challenges to the core it is this:

No intermediaries should be able to control or censor the creation, control, or transfer of value.

Through Ethereum and the growth of DAOs, we now have the ability to operate, vote, and coordinate autonomously. Implementing a DAO-like system of incubation can unlock the 98% of startups to get the resources they need to succeed.

In the same way Ethereum allows anyone to launch a smart contract into the world without permission of third-party intermediaries, Blockzero believes the chances of your success should be based on your passion, ability, and execution — not who you know or how much money you have.

The opportunity to create value in the world should be permissionless.

2) Elastic Capital Deployment

When YC wants to invest money into a startup, they have a finite amount of capital they can deploy. If YC has illiquid positions or are running low on cash, they either need to raise funds or sell positions.

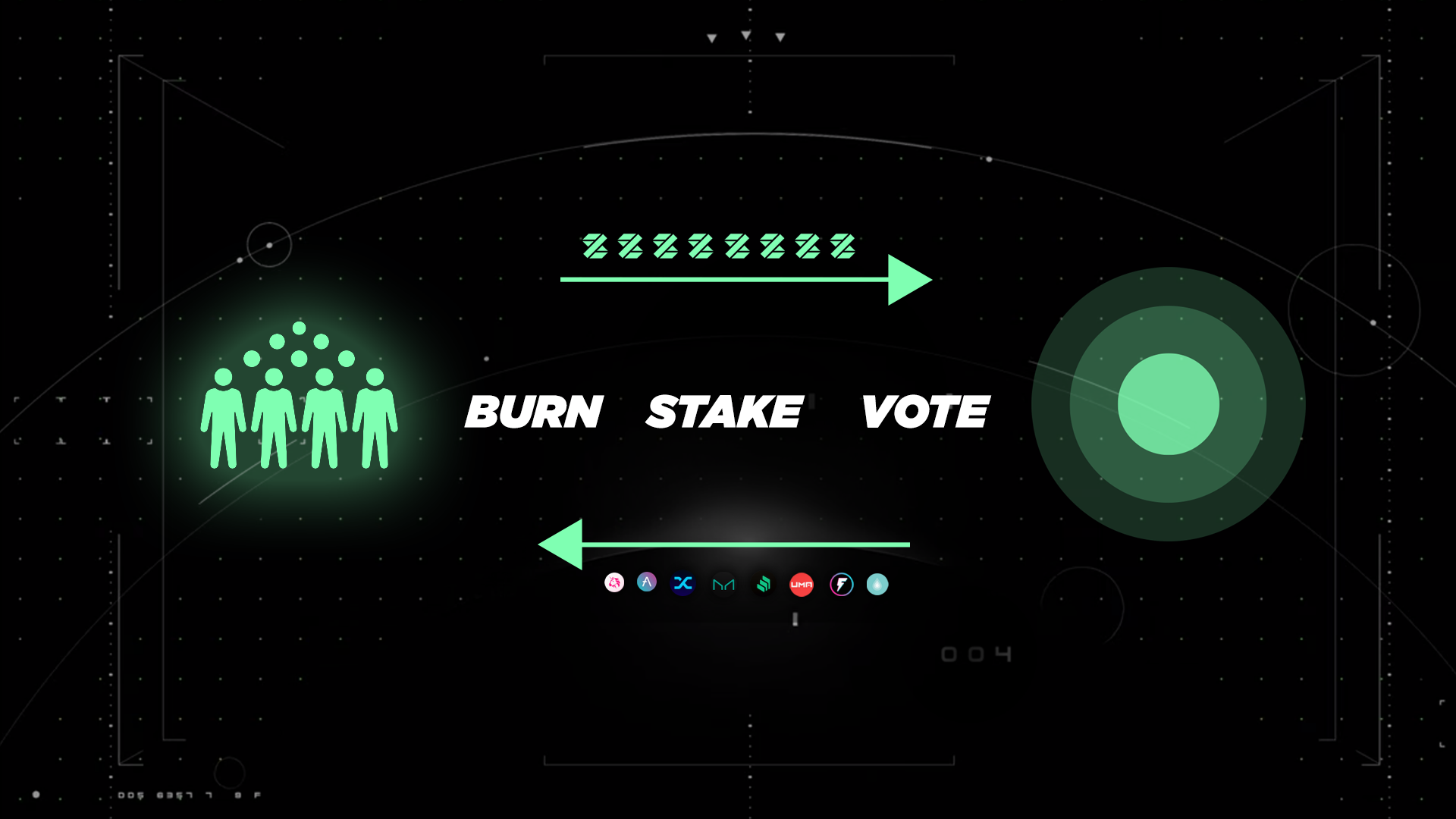

With Blockzero, however, the potential for capital deployment is dynamic, elastic, and dependent on the market cap of the native token: $XIO

With over 60M tokens currently in the Blockzero Treasury:

- If the price of $XIO were $0.33, there would be $20M.

- If the price of $XIO were $3.33, there would be $200M.

- If the price of $XIO were $33.33, there would be $2B.

As you can see from the numbers above, the network effect of value creation leading to more potential capital deployment acts as a frictionless flywheel for financial inclusion.

3) Tokens vs. Equity

While some blockchain projects do still have the influence of equity, a majority of these startups are token-based over equity-based.

Blockzero Labs believes the token-based model requires an entirely new and creative structure to succeed. This is why we created The Vortex.

4) Dynamic vs. Fixed Valuations

YC currently treats all startups the same in terms of startup valuation and capital allocation.

- All startups are either accepted or rejected

- All startups give up the same amount of capital

- All startups receive the same amount of capital

While it makes sense on why YC did this to automate the process and cut down on subjective clutter, this binary and objective process leads to some startups getting over-funded and some startups getting under-funded.

With with distributed nature of Ethereum and decision making processes at scale, startups can receive resource allocation in all shapes and sizes.

Blockzero allows projects to set their own valuation. If the market thinks it is over-valued, the project simply does not get the resources they need to scale.

5) Globalization of Talent and Time

Although YC has done a good job offering remote access during the Covid-19 pandemic, the model has historically been predicated on founders picking up their belongings and moving to Silicon Valley for extended amounts of time.

Additionally, with two batches a year than span three months each, six months out of the year there is no active accelerator (note: they do offer awesome startup school courses and education)

With Blockzero, anyone can apply from anywhere in the world at anytime they want. Innovation never sleeps.

6) Early Liquidity

The same day this article was written, Coinbase (a YC alumni) launched their IPO. Founded in 2012, it took over 8 years for YC to go public.

Although I don’t think YC will be complaining any time soon about one of their companies going public, this is a decent duration of time that they had to sit on illiquid assets.

In the decentralized world, projects are much more liquid in their early days. Some projects even jumpstart this process by launching with their very own Initial Liquidity Offering.

The early access to liquidity for Blockzero allows for a more efficient and dynamic use of capital.

7) Community Ownership

One of the biggest selling points of YC is the amount of highly talented individuals and mentors you will get connected with during your three months of incubation.

Although there will always be a place for advisors within a project, the decentralized world finds just as much value, if not more, throughout communities and the aligned-incentives that guide them.

More than ever before, community members share actual ownership in the network they are supporting.

- Uniswap gave away over $18M worth of tokens to users of their protocol.

- YFI gave 100% of their token to the users of their protocol.

- UMA is actively offering $60M+ to those who help increase their TVL

This deeper level of connection has shown to turn early adopters into early brand ambassadors willing to go above and beyond to help a project succeed.

Blockzero Labs currently has over 8000 community members we call Citizens ready to support and discover new blockchain projects.

Decentralize the World

We believe opportunity should be decentralized, automated, and permissionless. This is why we are building Blockzero Labs.

- Learn about XIO Tokenomics and the business model behind Blockzero

- Submit your project and apply to join Blockzero Labs

- Add liquidity to the ETH/XIO Liquidity Pool and earn 5–15% yield per month (up to 180% APY)

- Participate in governance decisions and earn up to $1500/month for providing feedback

- Become a Citizen and help us build, launch, and own the next generation of decentralized startups